Improving call center service

At Resolution Life, we understand that our call wait times are not where we want them to be.

We have made structural changes to our call centre and are hiring more call centre staff to make a difference here.

Tiered Service Model

At the start of April, we teamed together our engagement specialists within our call centre based on call type and complexity, to better leverage team experience as well as increase the speed of our onboarding processes. Our intention in doing so is to more appropriately route calls based on their complexity, as well as ensure that we can increase capacity to handle higher call volumes as required.

Our service tiers are:

- Simple insurance enquiries – covering enquiries that can be handle quickly, e.g. understanding policy details, change of beneficiary, change of address, gaining certificate of currency.

- Complex insurance enquiries – where they manage the more complex insurance queries that can be multi-faceted and require deeper insurance knowledge.

- Conventional and investment linked enquiries – where our specialists with specific product knowledge can support the needs of these callers.

Hiring more staff

Across Australia and New Zealand we had 10 engagement specialists start on the phones this month, and will have another 10 in early May.

Results so far

These changes are having a positive impact on call wait times. During January and February this year our Grade of Service (GOS) for adviser calls – which measures the % of calls answered within 90 seconds – was in the high teens. Our GOS during April has been around the mid-30s. We fully accept this needs to be higher and are aiming for a GOS during the year of 70 – 70% of calls answered within 90 seconds.

We will continue to keep you updated via the newsletter on how we are improving how we support advisers and customers.

Conventional products bonus rates

As part of a customer’s Whole of Life or Endowment policy, customers are entitled to receive profits earned on the value of the assets in the portfolio in the form of a bonus.

There are two types of bonuses available:

1. Annual bonus

2. End/Terminal bonus.

We are declaring higher Annual bonus rates for former-NMLA policies and former-AMP Life policies relative to the rates declared last year (an increase of 0.40%). These Annual bonus rates will apply on policy anniversary from 1 April 2023 for former-NMLA policies and from 1 May 2023 for former-AMP Life policies.

We are declaring unchanged End/Terminal bonus rates from 1 April 2023 (former-NMLA policies) and from 1 May 2023 (former-AMP Life policies) from the rates declared last year.

The Annual Statement will show the impact of this bonus declaration on the customer’s policy.

The bonus rate appendix at the end of this article sets out a selection of Annual and End/Terminal bonus rates applicable for various types of business and bonus scales.

What does this mean for policy owners?

Resolution Life has declared higher Annual bonus rates (an increase of 0.4%) from the rates declared last year. This means policies will receive higher annual bonuses as a proportion of Sum Insured and existing Annual bonuses compared to last year. These Annual bonuses will be credited to policies on their next policy anniversary. Once credited, it is a permanent (guaranteed) addition to their policy (unless bonuses are cashed, or the policy is altered).

The End/Terminal bonuses shown on Annual Statements represent the End/Terminal bonuses that would be received if a claim or maturity benefit was paid on the date the Annual Statement was produced. Unlike Annual bonuses, End/Terminal bonuses are not guaranteed.

Resolution Life are declaring unchanged End/Terminal bonus rates (effective from either 1 April or 1 May). While End/Terminal bonus rates are unchanged, with the additional Annual bonuses credited to policies since the previous year, the End/Terminal bonuses shown on Annual Statements will be higher than the previous year.

Withdrawal/surrender benefits will also typically increase with the additional Annual bonuses and unchanged End/Terminal bonus rates.

Please note: End/Terminal bonuses are not guaranteed which means that End/Terminal bonus rates can be increased or decreased at any time.

Setting bonuses and performance during 2022

The investment performance of the assets supporting these policies is an important factor in the levels of bonuses that can be declared. As market values fluctuate over time, we analyse investment performance since the last bonus declaration and update bonus rates to reflect the impacts of changes to investment markets and expected future earnings rates. Bonus rates are reviewed throughout the year, although changes normally occur from 1 April (former-NMLA) and 1 May (former-AMP Life).

When setting Annual bonus rates, Resolution Life considers both past returns and estimates of future investment returns, with the aim of declaring sustainable bonus rates over the longer term. Traditionally, movements in Annual bonus rates have trended directionally with historical movements in long-term bond yields. Long term bond yields influence our expectations for future investment returns and impact the amounts we need to set aside to ensure we can meet our contractual obligations to our policyholders. Over 2022, medium-to-long-term government bond yields in New Zealand increased substantially (by more than 2%), supporting increases to Annual bonus rates.

End/Terminal bonuses are a way of passing on a greater level of capital appreciation, usually from growth-oriented assets such as equities (shares) and property. While there is some smoothing of returns, End/Terminal bonuses more closely reflect actual investment returns and, as such, can be more volatile than Annual bonuses.

2022 was a turbulent year for financial markets, with concerns around rising inflation in particular impacting valuations. Against this backdrop, portfolio returns for the year from growth-type assets ended largely flat, with negative returns on equities (shares) largely offset by positive returns on property and infrastructure assets.

We aim to set Annual and End/Terminal bonus rates that are supportable and fair to our policyholders over the lifetimes of their policies. Accordingly, we are declaring increases to Annual bonus rates (an addition of 0.40%) and unchanged End/Terminal bonus rates relative to the rates declared last year.

The bonuses for a customer’s policy are shown on their Annual Statement.

How do bonus rates impact policy values?

Annual bonuses are credited on each policy anniversary as guaranteed additions to the sum insured and previously accrued Annual bonuses. End/Terminal bonuses for former-AMP Life policies are based on accrued Annual bonuses and End/Terminal bonuses for former-NMLA policies are based on sum insured, accrued Annual bonuses and the number of years the policy is in force.

Annual and End/Terminal bonuses are only payable in full on claim or maturity.

Like interest on a bank account, Annual bonuses accumulate and compound over time. Annual bonuses that are yet to accrue are not guaranteed.

End/Terminal bonuses reflect the investment returns not already added as Annual bonuses and are not guaranteed. The risk that a fall in market values reduces or even erases past capital appreciation means that we cannot guarantee payment of End/Terminal bonuses in the future and End/Terminal bonus rates can rise and fall.

The amount that would be payable now on any policy is the Withdrawal/surrender benefit.

Each Annual bonus added usually increases the Withdrawal/surrender benefit. If a policyholder does not wish to continue with their policy, a partial End/Terminal bonus may also be payable as part of the Withdrawal/surrender benefit, but this is not guaranteed. Consequently, where the End/Terminal bonus rates increase the Withdrawal/surrender benefit may increase. Conversely, reducing the End/Terminal bonus rates can result in Withdrawal/surrender benefits being lower.

As the full value of the sum insured and bonuses are only payable in full when the sum insured becomes payable (usually on claim or maturity), this means that the Withdrawal/surrender benefit for a policy is generally less than the amount received upon claim or maturity.

If bonus rates remain unchanged and premiums are paid on time as scheduled, Withdrawal/surrender benefits will typically increase as policies age.

More information

Please call us on 0800 808 267 or email askus@resolutionlife.com.nz for more information.

Appendix: Annual and End/Terminal Bonus Rates

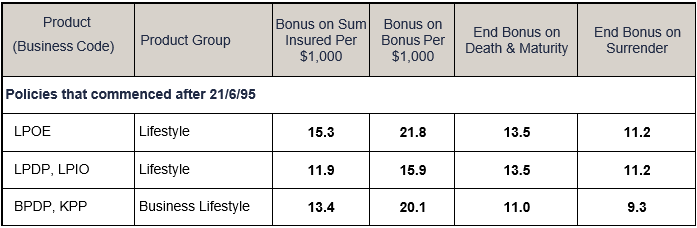

Former-NMLA Policies

The following bonus rates apply to former-NMLA participating Whole of Life, Endowment, Pure Endowment and Pre-Lifestyle Endowment policies on policy anniversaries, claims, and maturities from 1 April 2023 to 31 March 2024.

Note: For Pure Endowment Policies, bonuses are only paid if the life insured survives to maturity.

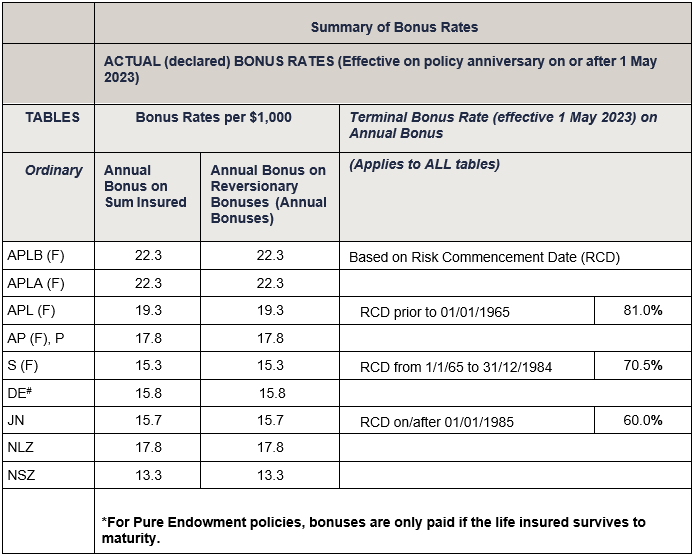

Former-AMP Life Policies

The following bonus rates apply to former-AMP Life participating Whole of Life, Endowment and Pure Endowment policies on policy anniversaries, claims, and maturities from 1 May 2023 to 30 April 2024 (main bonus tables shown below).

EasyQuote update needed to see new surrender value information

On April 21, our system updates for the new conventional surrender values will occur. For those advisers using EasyQuote to generate conventional product quotes, this means you must update EasyQuote to the latest version.

The new version will be available after 8 May 2023 and will also contain new bonus rate information.

To download from 8 May 2023, use this link for the updated version.

Adding your staff members to My Resolution Life – changes you need to know about

We’ve recently made updates to how your staff members can access My Resolution Life. These updates add an extra layer of security for your staff members when they log in to My Resolution Life.

What you need to know

- The process of setting up your staff member’s access is still largely the same, but you now only need to provide their name and email address up front.

- Your staff member will receive a personalised email invite for My Resolution Life. This invite now expires after 24 hours for security purposes. However, you can easily re-send the invite within My Resolution Life if you need to.

- You can now view a list of your staff members that you’ve invited to access My Resolution Life but haven’t yet accepted the invite.

- You can also cancel the invitation within 24 hours of having sent the invite, in the event that your staff member’s email inbox is compromised.

How to add staff members to My Resolution Life

We have detailed instructions in our newly launched My Resolution Life help centre.

We’re gradually expanding this help centre with more instructions on other features of the portal, so bookmark the page to easily access it in the future.

Increase to the interest rate on policy loans and premium arrears

Resolution Life has recently reviewed the interest rate charged for NZ Conventional policy loans and premium arrears on policies. Effective from 1 May 2023, the interest rate that applies to policy loans and premium arrears will increase from 4.5% to 8% per annum.

This interest rate change reflects the current market interest rates and economic conditions.

What does this mean for the customer?

With the change in the interest rate, customers may want to consider commencing or adjusting their payments to reflect this change and can do so via the following ways:

1. Contacting their financial adviser

2. Logging into My Resolution Life Portal via our website: resolutionlife.co.nz/myresolutionlife and using click to chat to talk to us online.

3. Filling in an online enquiry via our website: resolutionlife.co.nz/contact-us, or by

4. Calling 0800 808 267 (and quoting their policy number)

Important: the amount of debt will grow over time if customers do not adjust their repayment amount to reflect the change in interest rate or there are no repayments to the policy loan or premium arrears. This may result in the debt reaching a level which would see the policy and the insurance benefits cease.

For more information on their policy loan and/or premium arrears, customers can refer to their 6-weekly statement.

Future interest rate changes

The interest rate charged for policy loans and premium arrears on policies is set by Resolution Life and is subject to change from time to time.

Advisers and customers will continue to be notified of any future changes to the interest rate including the date the new interest rate takes effect.

Important information

Resolution Life Australasia Limited ABN 84 079 300 379, NZ Company No. 281363, AFSL No. 233671 (Resolution Life). The content on this website is for information only. The information is of a general nature and does not constitute financial advice or other professional advice. Before taking any action, you should always seek financial advice or other professional advice relevant to your personal circumstances. While care has been taken to supply information on this website that is accurate, no entity or person gives any warranty of reliability or accuracy, or accepts any responsibility arising in any way including from any error or omission.

A disclosure statement is available from your Adviser, on request and free of charge.